Leaving the U.S. – Financial Planning Tips & Traps

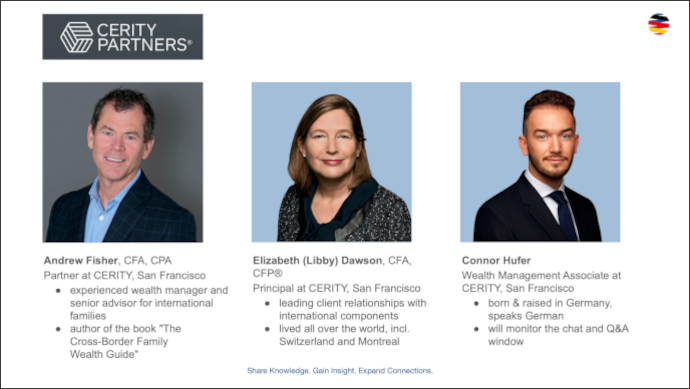

Andrew Fisher and Libby Dawson from Cerity Partners, a long time GABA corporate member, held a webinar on “Leaving the U.S. – Financial Planning Tips and Traps” on March 20, 2024, with a focus on the financial consequences of emigrating from the United States. Andrew and Libby are part of a specialized team within Cerity Partners that advises families in cross-border situations.

While the U.S. has long attracted people from all over the world, there seems to be an increasing number of people leaving the U.S. for a variety of reasons, both natural-born U.S. citizens and long-time residents. There has been a proliferation of special visas and residency or citizenship schemes, such as “Golden Visas” that make such emigration more enticing. For many GABA members, there is the natural inclination to return to Germany. Deciding to leave may or may not be easy but extricating oneself from the U.S. financial system is definitely not easy. Those decisions can actually be very complicated.

At this online meeting, which was attended by more than 80 participants, the discussion focused on four key financial elements – assets left in the US; cross-border taxation; estate planning; and expatriation and the exit tax – and how one’s legal status with the U.S. (citizenship, permanent resident, or non-resident) affects those areas.

Most financial assets should be left in the U.S., in particular retirement accounts, especially as a U.S. citizen or permanent resident. Many people prefer to keep any real estate that they have in the U.S. as a good, long-term holding. There will be some complications from dealing with cross-border taxation, but it is likely worthwhile. The U.S. system of taxation of its taxpayers regardless of residence can be cumbersome, but due to the availability of tax exclusions and credits, it is unlikely that anyone returning to Germany will face additional taxes. A U.S. person residing in a lower-tax country will find that the U.S. taxes become the dominant ones. Taxes on investments and other types of passive income can be more challenging. Cutting your tax reporting obligations to the U.S. is the main reason people want to leave after a few years or expatriate.

Expatriation is the system to renounce your legal standing in the U.S. if you are a citizen or have been a long-term permanent resident. For some people, this may trigger an exit tax, or a deemed disposition of their assets to true up their tax liability to the U.S. The tax calculation is complicated. And, very importantly, an expatriation can lead to an undue estate tax burden on remaining U.S. heirs. Estate planning is quite different and much more flexible and generous in the U.S. versus Germany and is the single largest reason, outside of easy access to the U.S., that emigrants choose to retain their U.S. status.

GABA extends its deep gratitude to Andrew Fisher and Libby Dawson from Cerity Partners for sharing their expertise during this information-packed hour on Zoom. While this GABA event was free for our members, Cerity Partner also offers a free one-hour consultation to any GABA member, during which they will learn about your individual situation and questions, and offer personalized advice and suggestions for where to learn more. If you have questions, please feel free to contact Andrew Fisher (afisher@ceritypartners.com) and Libby Dawson (ldawson@ceritypartners.com) directly.